One of the most common questions I get when meeting with people is “What is a Tetrant?” Check out the latest video to learn more!

TUESDAY TIP

TUESDAY TIP

THE REALITY OF INVESTING DURING RETIREMENT

Decades ago, the “typical” retiree left work for good between age 60-65 and typically passed away at about 70-75. Retirement lasted 10-12 years for many Americans. Now the picture has changed: some of us will spend 30, 40, perhaps even 50 years in retirement. (Imagine retiring at 55 and living to be 105 … it is possible.) We may live much longer than our parents, and if we do, we will need a lot more money.

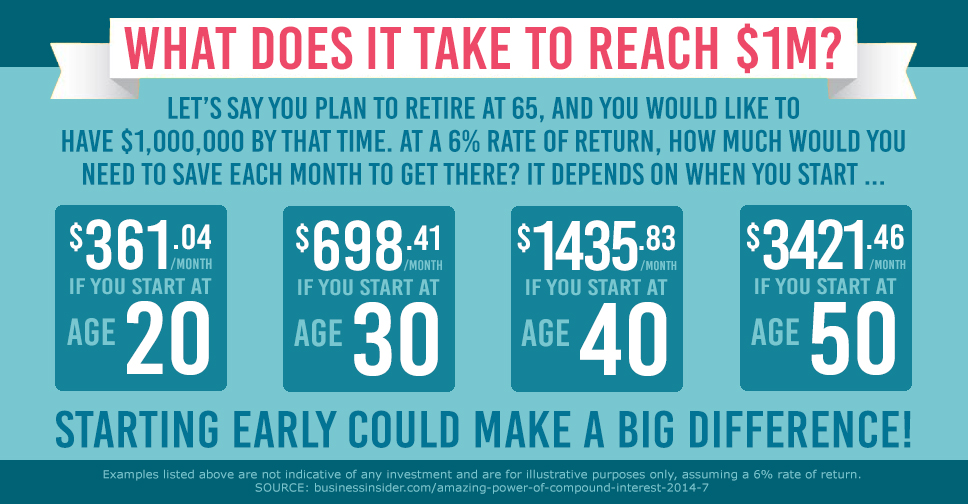

INVESTING AT AN EARLY AGE

You’ve probably been told at least a few times in your life that you should be putting money aside “for a rainy day”, but perhaps it hasn’t yet crossed your mind to begin planning, specifically, for your future retirement. If you think it’s too early, or if you feel you’re not yet ready, financially … think again.

TUESDAY TIP

FIDUCIARY STANDARDS vs. SUITABILITY STANDARDS

If you meet with a financial professional, be sure to ask a critical question. If you make an appointment with a financial consultant on behalf of yourself, your family or your company, make the following inquiry before the meeting ends:

“Are you held to a suitability standard or a fiduciary standard?”

TUESDAY TIP

ARE YOU UNDERFUNDING YOUR RETIREMENT?

401(k) Plan Sponsors Can’t Ignore Fiduciary Duty

Inattention may open the door to liability & severe penalties. Do your employees have a company retirement plan? If they do, then you have a fiduciary responsibility to them. Ignoring it to any degree could really cost you.