TUESDAY TIP

Mind Over Money

A degree of emotion also factors into many of our financial choices. There is even a discipline devoted to how our emotions affect our financial decisions: behavioral finance. Examples of emotionally driven financial behaviors are all around us, especially in the investment markets.

THE REALITY OF INVESTING DURING RETIREMENT

Decades ago, the “typical” retiree left work for good between age 60-65 and typically passed away at about 70-75. Retirement lasted 10-12 years for many Americans. Now the picture has changed: some of us will spend 30, 40, perhaps even 50 years in retirement. (Imagine retiring at 55 and living to be 105 … it is possible.) We may live much longer than our parents, and if we do, we will need a lot more money.

INVESTING AT AN EARLY AGE

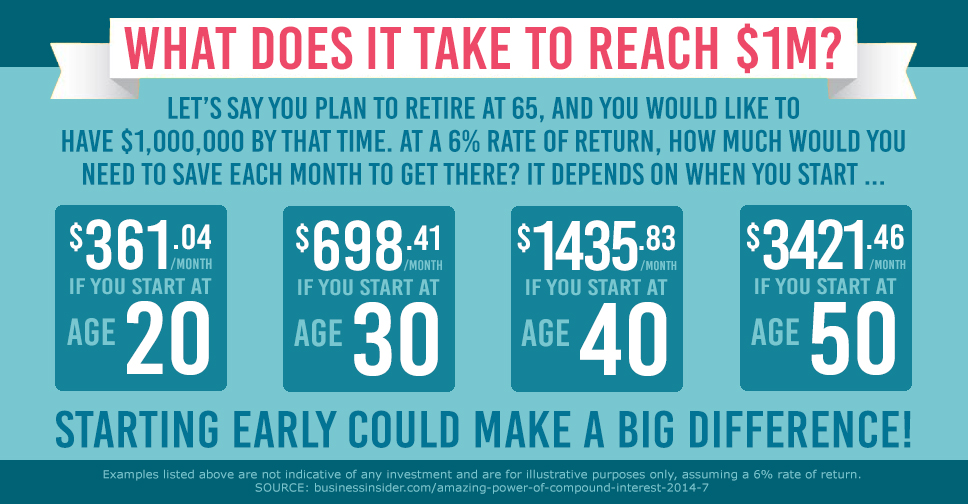

You’ve probably been told at least a few times in your life that you should be putting money aside “for a rainy day”, but perhaps it hasn’t yet crossed your mind to begin planning, specifically, for your future retirement. If you think it’s too early, or if you feel you’re not yet ready, financially … think again.

TUESDAY TIP

TUESDAY TIP

TUESDAY TIP

TUESDAY TIP

THE U.S. SAVINGS BOND TAX TRAP

Did you buy U.S. Savings Bonds decades ago? Or did your parents or grandparents purchase some for you? If so, take a look at them before April 15 rolls around. Your bonds may have matured. That means they are no longer earning interest, and it also means you need to cash them in.